Executive Summary: The Good, The Meh, and The “Show Me”

Current Price: $130.00 (as of June 23, 2025)

Market Cap: $208B

Rating: Hold with Upside Potential

Price Targets: $120-$180 range

AMD has pulled off one of tech’s greatest comeback stories, transforming from Intel’s perpetual runner-up into a legitimate AI and datacenter powerhouse. But here’s the thing – after climbing from $10 to $200+ in just five years, and now sitting at fresh highs near $130, the easy money has definitely been made. With the stock up ~10% since June 12th alone, we’re clearly in “prove it” territory.

The Bull Case: Why AMD Could Still Surprise You

1. Chiplet Architecture = Secret Sauce

AMD’s modular chiplet design isn’t just engineering flexing – it’s a real competitive moat. While NVIDIA burns cash on massive monolithic dies, AMD can mix and match components like AI Legos, delivering:

- ~30% lower cost per token vs NVIDIA’s B200

- Superior yields (more working chips per wafer)

- Faster time-to-market for new products

2. The “Second Source” Premium

Every hyperscaler learned a painful lesson about single-vendor dependency during the GPU shortage. AMD is now the preferred “Plan B” (which is actually a good thing when Plan A costs 3x more):

- 7 of top 9 AI companies now use AMD Instinct GPUs

- Microsoft, Meta, Oracle, OpenAI all publicly backing AMD

- 40% projected server CPU market share by 2026

3. Financial Momentum is Real

- Data Center revenue: $12.6B in 2024 (+94% YoY)

- Q1 2025 growth: +57% in datacenter segment

- Gross margins: Improved to 50% (vs 46% in 2023)

- Cash position: $7.3B with manageable $4.2B debt

The Bear Case: Where Things Get Spicy

1. The CUDA Moat is Still Everest-High

Let’s be real – despite all the ROCm 7 (AMD’s answer to CUDA) progress, porting from CUDA is still 4-5x slower than native development. That’s not a small problem when your competition has a decade head start on software ecosystems.

2. China Revenue Cliff

Export restrictions could subtract $1-1.5B annually – that’s roughly 5% of total revenue. Not exactly a rounding error.

3. TSMC Dependency = Single Point of Failure

AMD’s entire AI strategy relies on TSMC’s advanced nodes. If geopolitics or supply chain hiccups hit Taiwan, AMD’s roadmap gets scrambled.

4. Valuation Now Assumes Even More Perfection

At nearly 37x 2025E earnings and $208B market cap, AMD is pricing in not just flawless execution of the MI400 ramp, but also perfect timing, zero competitive response, and continued market expansion. The recent 10% pop to $130 has made an already stretched valuation even more demanding.

Peer Comparison: The AI Semiconductor Hunger Games

| Company | Market Cap | 2025E P/E | Revenue Growth (2025E) | AI Exposure | Moat Strength |

|---|---|---|---|---|---|

| AMD | $208B | 36.9x | +36% | High (Instinct GPUs) | Moderate |

| NVIDIA | $2,800B+ | 45x+ | +50%+ | Extreme | Fortress |

| Intel | $120B | 18x | -5% | Low (Gaudi struggling) | Crumbling |

| Marvell | $65B | 25x | +20% | Medium (Custom ASICs) | Niche Strong |

| Broadcom | $580B | 22x | +15% | Medium (Networking) | Platform |

The Takeaway: AMD sits in the awkward middle – more expensive than Intel but with better growth prospects, cheaper than NVIDIA but with way less AI dominance. At $130, the valuation gap vs alternatives like Marvell is becoming harder to justify.

Technology Deep Dive: The MI400 Moment of Truth

Current Gen: MI350/355 Series (Shipping Q3 2025)

- 288GB HBM3E memory (vs NVIDIA B200’s specs)

- 35x inference performance improvement vs MI300

- 4x compute performance vs previous gen

- Early verdict: Competitive with B200, but software ecosystem still trails

Next Gen: MI400 Series (2026 – The Make-or-Break Year)

- 432GB HBM4 memory (vs NVIDIA Rubin’s 288GB)

- 40 PetaFLOPS FP4 performance

- 10x inference uplift vs MI355 (though this includes software gains)

- Reality check: Performance specs look great on paper, but can AMD deliver on time and scale?

The Helios Rack Strategy

AMD’s betting big on full-stack solutions:

- 72 GPU racks with integrated networking

- 50% more HBM capacity than NVIDIA NVL72

- Open Ethernet/UALink (avoiding vendor lock-in)

Translation: AMD wants to sell complete AI infrastructure, not just chips. Smart strategy, but execution risk is massive.

Financial Deep Dive: Show Me the Money

Revenue Mix Evolution (The Story in Numbers)

| Segment | 2024 Revenue | 2024 Mix | 2025E Growth |

|---|---|---|---|

| Data Center | $12.6B | 49% | +57% |

| Client (PC) | $7.1B | 27% | +10% |

| Gaming | $2.6B | 10% | -20% |

| Embedded | $3.6B | 14% | +5% |

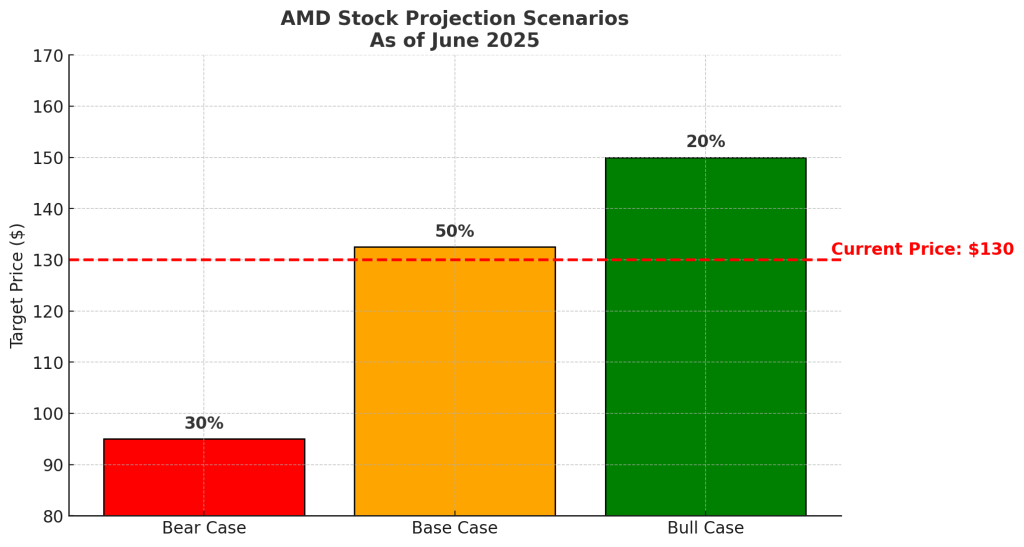

Investment Scenarios & Stock Probability Map

| Scenario | Probability | Price Target | Upside/Downside |

|---|---|---|---|

| Bull Case MI400 launches on time with CUDA-level software support; AI inference outpaces training; China restrictions ease; continued Intel struggles. | 20% | $150+ | +15% or higher |

| Base Case Stable GPU market share (~10% by 2026); steady server CPU growth; moderate global offset to China headwinds; gradual ROCm improvements. | 50% | $125-140 | -4% to 8% |

| Bear Case MI400 launch delays or underperformance; widening CUDA ecosystem gap; strong ARM CPU market penetration; expanded export controls; valuation compression due to execution misses. | 30% | $95 | -27% |

Investor Fit Matrix

| Investor Type | Fit Level | Strategic Recommendations |

| Growth Investors | ★★★★☆ | Aggressively accumulate around key product launches; leverage call options during earnings catalysts. |

| Value Investors | ★★★☆☆ | Cautious positioning due to valuation; hedge exposure with protective puts and balance with value ETFs (e.g., VTV). |

| Income Investors | ★★☆☆☆ | Limited dividend appeal; deploy covered call strategies regularly; consider dividend-focused ETFs like DGRO. |

| Thematic Investors (Semiconductor Innovation) | ★★★★★ | Strong thematic fit; strategically position alongside semiconductor-focused ETFs such as VanEck Semiconductor ETF (SMH), iShares Semiconductor ETF (SOXX), and Global X Internet of Things ETF (SNSR). |

Peer Deep Dive: Know Your Competition

NVIDIA (The 800-lb Gorilla)

What they do right: CUDA ecosystem, first-mover advantage, vertical integration

Where they’re vulnerable: Pricing power invites alternatives, supply constraints

AMD’s angle: Cost-performance arbitrage for inference workloads

Intel (The Fallen Giant)

What went wrong: Process delays, product missteps, management chaos

Current status: Gaudi 3 shows promise but lacks roadmap depth

AMD’s opportunity: Server share gains while Intel rebuilds

Marvell (The Custom Silicon Play)

Why they matter: ASIC design for hyperscalers, networking expertise

Valuation edge: Trading at 25x vs AMD’s 34x despite similar growth

Comparison verdict: At current prices, Marvell is definitely the better risk-adjusted play

Investment Thesis: The Millennial Take

Why AMD Could Work for Your Portfolio

- Diversification play: Not pure AI exposure like NVIDIA

- Secular server trends: Cloud migration isn’t stopping

- Geographic balance: Less China-dependent than pure plays

- Execution track record: Lisa Su’s team has delivered for 8+ years

Why You Should Probably Wait

- Valuation now stretched beyond comfort: Paying 37x earnings for tomorrow’s dreams

- Recent momentum looks frothy: 10% gain in 3 days suggests FOMO buying

- Binary outcomes with higher stakes: MI400 success is make-or-break at these levels

- Better alternatives exist: Marvell offers similar upside with 30% lower valuation

- Timing risk amplified: Buying after a fresh breakout requires perfect execution

The Bottom Line: Equal Weight (Hold)

AMD deserves credit for an incredible transformation. The company went from survival mode to challenging NVIDIA in AI – that’s not luck, that’s execution. But here’s the harsh reality check: at $130 and 37x earnings, you’re paying premium prices for a perfect future that may never materialize.

Consider: The recent 10% pop to fresh highs smells like FOMO territory. If you want AI exposure, AMD now offers worse risk-adjusted returns than alternatives. The smart money is either:

- Waiting for a 20-25% pullback to reasonable entry levels

- Clear MI400 traction in early 2026 (and accepting higher prices)

- Buying Marvell or the broader semiconductor ETF instead

Position sizing: If you absolutely must own AMD at these levels, make it a 3-5% speculative position, not a core holding. The company’s great, but the price is getting rich.

Honest take: We love the AMD comeback story, but loving the company doesn’t mean loving the stock at any price. Sometimes the best investment decision is doing nothing.

Final Call: What Should You Actually Do?

Consider waiting at $130 if you:

- Are new to AMD or semiconductor investing

- Need this to be a core holding in your portfolio

- Are purely momentum chasing the recent 10% move

- Want maximum risk-adjusted returns

Wait for a better entry if you:

- Believe in the long-term AMD transformation story

- Can be patient for a few quarters

- Want to enter around $110-115 (better risk/reward)

- Understand you might miss some near-term upside

Start building a position at $130 if you:

- Have strong conviction in the AI thesis

- Believe MI400 will be a game-changer

- Want exposure to the second-best AI infrastructure play

- Can dollar-cost average and handle volatility (2-3% position max)

Alternative plays worth considering:

- Marvell (MRVL): $65B market cap, 25x P/E, growing 20% annually with custom ASIC design wins at hyperscalers. Gets you AI exposure without the software execution risk

- Broadcom (AVGO): $580B market cap, 22x P/E, 15% growth driven by AI networking chips and VMware integration. More mature, less volatile than pure AI plays

- SMH ETF: Diversified semiconductor exposure (23% NVIDIA, 5% AMD, 4% Intel) without single-stock concentration risk. Up 25% YTD vs AMD’s 35%

Valuation Takeaways:

Fair value range: $125-140 (accounting for growth prospects)

Momentum target: $150-180 (if AI narrative accelerates)

Support levels: $115, then $105

Timeline: 6-12 months for major catalysts

Our Call: AMD’s transformation is real, and they’re genuinely challenging NVIDIA in key areas. The MI400 launch in 2026 could genuinely be a game-changer if AMD executes well – and their track record under Lisa Su suggests they will. The chiplet architecture advantage is real, the customer relationships are solid, and the total addressable market is massive. Yes, $130 isn’t cheap, but sometimes you pay up for quality execution in massive markets. We’d consider starting a small position (5% max), accumulate after pullback to $110-115 for better risk/reward. Alternatively, long Q2 2026 OTM Call.